paydayloanalabama.com+calvert no credit check loan payday

Knowing the charge and you can will set you back regarding refinancing your residence financing

While contemplating refinancing your home financing, this action-by-step publication explains what to expect and how to navigate the procedure.

Which have rates at a most-time lower across Australian continent, number variety of homeowners are utilising the opportunity to get a hold of a lot more cost-active or versatile income on the lenders step one . Exactly what, precisely, will it mean so you can re-finance a home, just in case is-it useful?

Refinancing can mean talking-to your existing vendor to help you renegotiate the arrangement with these people (an internal refinance), however it will means switching to a unique bank in order to safe a better price (an external re-finance).

There are lots of reasons why you should imagine refinancing, out of spending less by reducing your monthly money, so you can decreasing the title of the mortgage, in order to accessing mortgage enjoys you to definitely best meet your requirements, and you will consolidating almost every other expense (for example unsecured loans or auto loans) in one straight down rate.

Start by using a beneficial refinance calculator locate a sense of what you are able save from the refinancing. Next crisis the brand new number into home financing research calculator to contrast your loan to many other example fund, observe what can perform best to you.

Additionally it is a smart idea to think if the economic positives off reworking the borrowed funds exceed any potential costs and you will will cost you.

There are numerous reasons to consider refinancing, of saving cash so you can combining most other costs at the same straight down rate.

Yes, a large part off refinancing is about saving cash in the overall by getting a far greater rates on your home loan. Before you make the alteration, it is advisable to verify you are getting everything else your need, also. Talking about a few of the mortgage keeps you to Amplifier also offers according to product; other lenders you’ll give comparable otherwise different choices:

- The fresh new studio and then make additional repayments as opposed to penalty for the adjustable-rates mortgage

- Multiple financing breaks (ranging from fixed and you can adjustable) in the no additional pricing

- The capability to redraw for the varying mortgage brokers

- Online and you will cellular banking

- No annual bundle charges

- No monthly membership management charge

- Favor how you pay of the financing with prominent and interest, or attract simply payments

- Create most repayments to your funds

- Financial assistance from inside the valuation fees

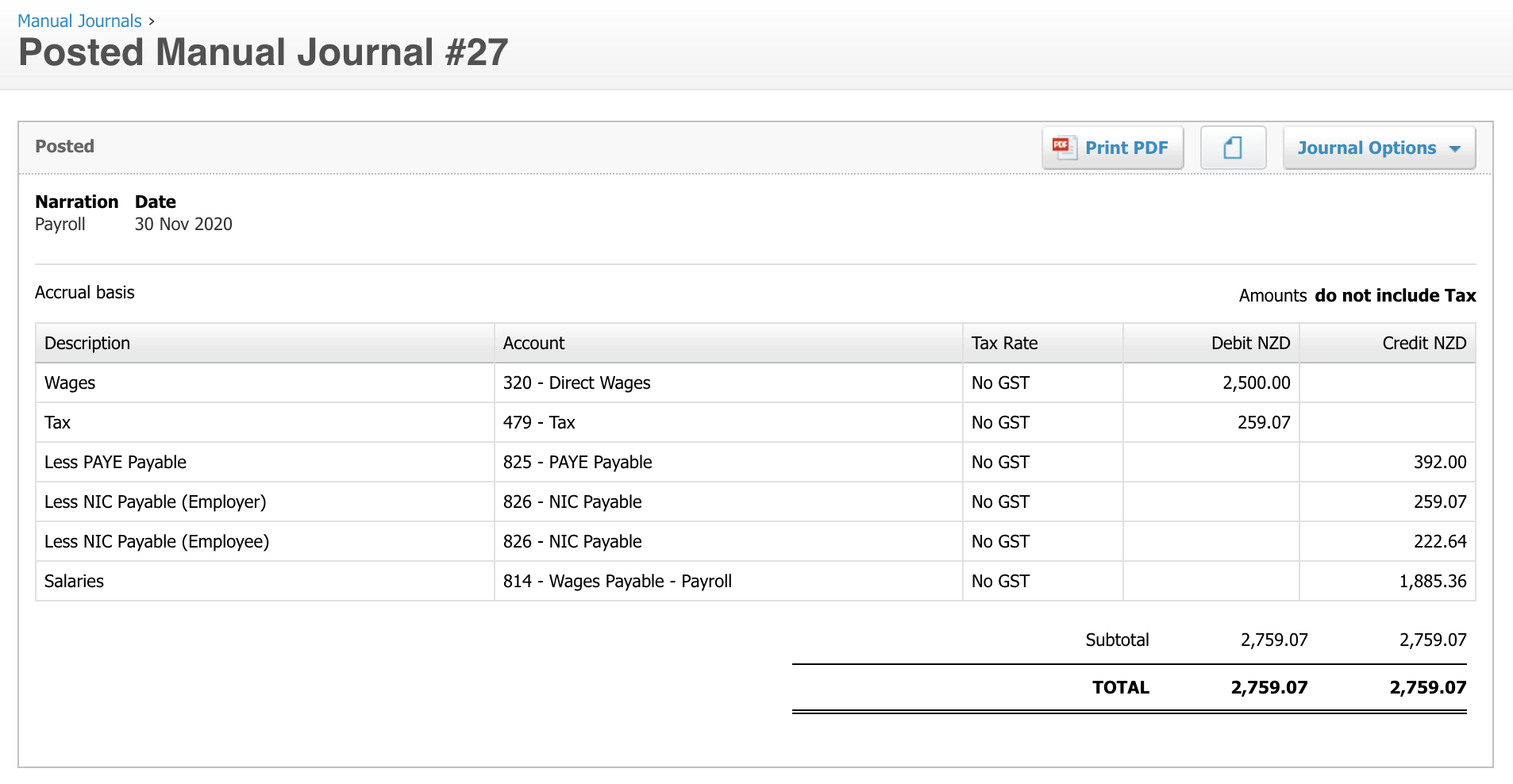

Before you can get also caught up in comparison-hunting, also be conscious that you might run into each other brief-term and ongoing fees when refinancing your home financing. These may are:

If you’ve opposed mortgage products on the market, focus on the new sums, and determined that the key benefits of refinancing outweigh the expense, the next thing is to set up an application having an effective new lender.

A file number for refinancing the home payday loans Calvert loan

When it comes to refinancing your residence loan with a brand new lender, it pays to be prepared. A loan provider will generally want to see:

Additionally need complete an application, that will require some of the more than info and much more information concerning your dependents, property and you can liabilities, the objective of the mortgage, the mortgage matter you will be seeking to along with your monthly expenditures. Then you will have to supply truth regarding the property by itself, for instance the label deeds.

How-to log off your existing home loan

The next phase is to accomplish home financing Launch Authority Means together with your newest bank really loan providers have this type of online. This will ask you regarding the property, the main anyone in it, as well as the loan account details. It will also offer home elevators financial charges and you will people regulators charge might face when you finalise their leave app.

Leaving your current financial and you may obtaining another you to can be a period-consuming processes. An amplifier home loan expert takes the pressure of refinancing and you will automate the procedure of application from the liaising together with your current financial to ascertain your hop out charge, over the release form and you will secure your own property’s label deeds.